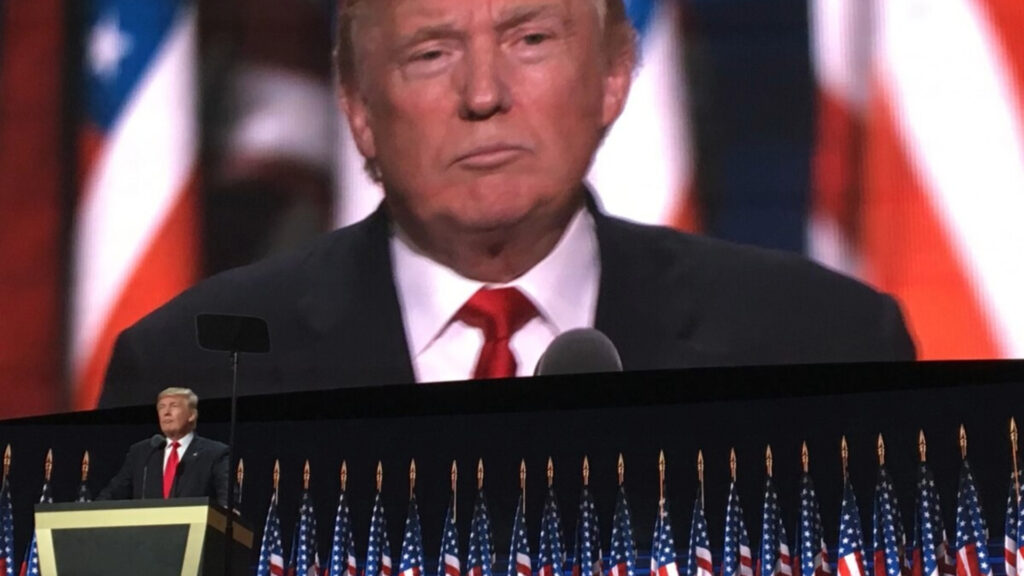

Donald Trump has made a name for himself as an allegedly stellar businessman, with outlandish claims of his business success as well as his wealth. These claims, in part, helped him to win the presidency in 2016, and in the years since he left the White House, he has doubled down on his efforts to make a lasting name for himself in the business world.

Dipping into the Social Media Space

The latest industry that Trump has been dipping into is social media. After he was banned from Twitter, Facebook, and Instagram in 2021 for violating their rules on inciting violent conduct, he decided that he wanted to create a space on the internet where he, and his conservative followers, could engage with each other without worrying about running afoul conduct rules of other platforms.

The goal to create a “Twitter space, but for conservatives” birthed Truth Social. Much like Twitter, now known as X after a rebranding by Elon Musk, Truth Social allows people to post and repost, as well as like and comment on other’s thoughts to foster discussion.

A Rocky Start, and Middle, and Now

Truth Social has had a rocky go of it, starting from the beginning. While there was initially a surge in activity to the new platform, particularly of Trump followers who left Twitter to support him in this new venture, the traffic quickly dissipated.

Traffic to Truth Social has steadily declined in the months and years since it debuted, though you wouldn’t know that, to listen to Trump. He has claimed, falsely, that Truth Social is the most popular social media platform on the internet, and has bragged about its profitability in contradiction to tax returns and filings with the FTC.

Pushing to Expand

The fact that Trump Media – the parent company that owns Truth Social – has struggled with profitability hasn’t stopped Trump from pushing the organization to grow and expand far beyond its limits.

In pursuit of bigger, and better, and more, Trump Media expanded their offerings, and in March of this year, the company went public and started trading on the stock exchange.

Stock Prices Jumping, in the Beginning

The shares of Trump Media – which trades under Donald Trump’s initials, DJT – initially surged when the company went public. They peaked at a high of $79.38 per share, but the high of the company was incredibly short lived.

Over the weeks following that initial bump in the stock price, the value of DJT slowly declined. At its current price, Trump Media is worth approximately half of the peak value that was seen on March 26, and this fact has caused some trouble in the leadership at Trump Media.

A Letter to House Republicans

Following weeks of the stock price falling, Trump Media CEO finally sent a letter to some allies on Capitol Hill, asking House Republican committee leaders to investigate possible “unlawful manipulation” of its stock.

Devin Nunes, the CEO, asked the GOP chairs to probe “anomalous trading” of the stock to gauge the extent of the alleged manipulation. He also asked in order to determine “whether any laws including RICO statutes and tax evasion laws were violated.”

DJT Falling Victim to Short Selling

This congressional request follows an accusation from Nunes that DJT has been the victim of “naked” short selling.

Short selling is a practice where investors bet that a stock will fall in value. Typically, short sellers borrow shares of a stock they believe will lose value, and then sell the shares on the market to pocket the money from the sale. Later, if the stock price falls as they predict, the traders will purchase the stocks back at a lower value to return to the company the borrowed from, and keep the difference of the initial sale price and the ultimate purchase price.

A Legal Practice, Though Unethical

Short selling is a legal practice in the financial sector, but can create significant manipulation of a stock on the market. In a statement regarding the issue released on Tuesday, Trump Media said that it wants to advise “long-term shareholders who believe in the company’s future” about how to prevent their shares from being used in such a trade.

Methods of protecting their investment includes opting out of securities lending programs, which would allow brokers to lend their shares, as well as making sure the stock isn’t held in a margin account.

The Most Expensive Stock to Short

If the accusations of short selling are true, the company was far and away the most expensive U.S. stock to short as of early April. Nunes pointed this out in the letter to the GOP, stating that brokers therefore “have a significant financial incentive to lend non-existent shares.”

Nunes says that the probe is necessary to protect the company’s shareholders, and to ensure that “the perpetrators of any illegal activity can be held to account.” Spokespeople for the four chairmen did not immediately response to requests for comment on the letter, but the situation is ongoing.

Shares of DJT Shooting Up in Value

After it was announced that the CEO was asking Congress to intervene with the company, shares of DJT shot up more than 9%. It’s unclear what ultimately caused the increase in the stock price, though the timing is admittedly suspect for financial experts familiar with the market.

This suspicion is exacerbated by the fact that the jump in price came one day after a deadline passed for former President Donald Trump, the company’s majority owner, to become eligible for an additional 36 million “earnout” shares, the stake of which was valued at $1.3 billion as of the then share price.

Trump Earning a Bonus

This “earnout” incentive was created for the public market debut of the company, according to a regulatory filing. In order for Trump to get the additional shares of the company, which are on top of the current 57% ownership stake, Trump Media needed to trade at or above $17.50 per share for any 20 trading days in a 30 trading day period.

While DJT did ultimately meet this bar, Trump won’t be able to cash out the new stock immediately. He and other Trump Media executives are largely restricted from selling their shares, for about another five months. These types of lockup periods are common with newly listed companies, in an effort to stabilize the value of a company in the early days of its public debut.

A Windfall for Trump

This windfall for Trump comes as the man is facing increasing scrutiny and pressure regarding his finances. On paper, DJT will have a value of $3.7 billion, meaning that Trump may ultimately find himself liable for more significant damages in his ongoing court cases, as well as responsible for a significant amount of legal fees.

And Trump is not the only person who benefits from the success of the company on the stock market. Many of Trump Media’s shareholders are individual investors, as well as supporters of the former president.

Discussions of “Meme” Stocks

The base of Trump fans who have largely bought the stock have prompted conversations on the internet around “meme” stocks, such as Gamestop. These types of stocks typically attract individual investors based on social media buzz, rather than traditional financial metrics that are favored by investors.

This means that the stock can be increasingly unstable, as people purchase the stock for social clout or conversational supply. Stock prices are only as stable as their long-term investors, and a stock which is constantly being purchased and sold over short periods of time is ultimately a bad investment, and will fail on the market.

A Financial Risk, and Potential Loss

Whether DJT is actually a victim of short selling will need to be determined by an independent investigation into the stock’s patterns and practices. Nunes’ accusations regarding the matter are bold, but ultimately have very little evidence to support them, beyond the falling stock price of DJT.

Investigation into financial markets is not a top priority for Congress, so it’s unclear whether Nunes’ letter or any investigation into Trump Media will actually bear fruit. Ultimately, Trump may have placed a bet on the company in the public market, and it might not pan out the way that he, and many hopeful investors, hoped that it would.

GIPHY App Key not set. Please check settings